Compounding, usually refers to the rise in value of an asset from interest earned on the initial principle down with accumulated interest over time. Resulting in a time & asset evaluation, also known as Compound Interest. While compound Interest increases the value of an asset more passively, On the opposite, a loan can cause a negative interest effect on a individual who decides to take a loan.

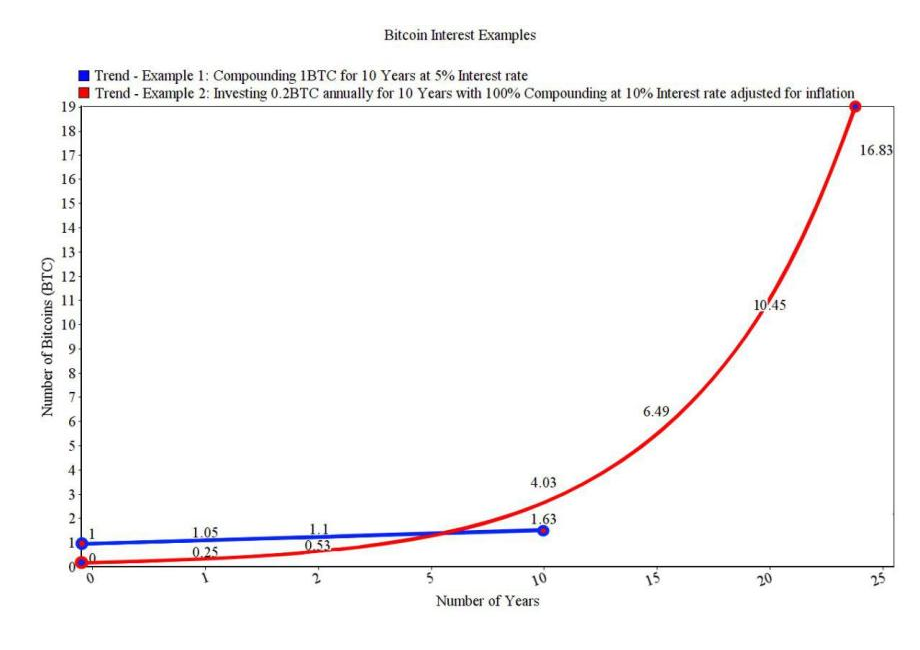

To explain how compounding provides incentive to holding long, lets say 1 BTC is held in a wallet that pays 5% interest annually. After the first year, the total balance in the wallet has gained up to 1.05 BTC, a reflection of 0.05 BTC in interest added to the 1 BTC principle, the wallet gains 5% growth on the original principal (1 BTC) and the 0.05 BTC of first year interest, resulting in a second year gain of 0.0525 BTC and a balance of 1.125 BTC after the first 2 years. As long as no withdrawals take place, and a steady 5% interest return remains. The wallet balance would grow to 1.625 BTC in 10 years, creating a steeper compound curve with time and value.

Here is a curve chart drawing, showing a alternative basic method of compounding over time. Resulting in significant growth.

With the above example you may see that holding an asset long, pays a bigger return over time. The longer you may hold the better in most cases. This is of course subject to risks, companies may go bankrupt, houses catch on fire, and nothing is fail proof. The risk must be considered, and is apart of the equation and evaluation of a long term held asset, each sector has a basket of risks included.

Compounding has been around for hundreds of years. As time moves along, and technology evolves, the common person has access and more options in relation to compounding investments. In example, things like real estate, dividend stocks, and verifying crypto transactions are currently some of the most popular selections.

Another example of compound interest is called income investing, usually offering some sort of return on investments also known as ROI. Historically these type of investors find a way to use the income generated from one asset, to supply funds to put into another income investment. Resulting in a diversified portfolio and more than one stream of income from your investments. This also helps balance risk. When diversified properly between sectors, one asset may be down in market evaluation, while another asset, from a different sector, may be up in market value. This creates a more balanced approach, along with more flexibility, also eliminates a layer of risk involved like holding all eggs in one basket as a example.

Compound Interest, income investments, and alternative cash flow sources of income can help create financial independence, establishing a nice form of retirement pensions, and provide a long term growth portfolio. Enabling the normal person the opportunity to have financial freedom. Compounding creates a way to have a passive income with out doing any back breaking work.